New API Endpoints

Nov. 19, 2020Querying for the market data you need is now easier than ever.

All Bonds Endpoint

Via this endpoint, you can retrieve a comprehensive list of all the bonds which had market data events for a given day. This list is further enriched with market sector information so you can quickly winnow down the list to the sectors you care about without further joins or cross-referencing. The All Bonds endpoint is considered metdata, and is costless from a quota perspective. This query is ideally suited to ensure your local data store is up-to-date at the end of every business day.

Deal Classes Endpoint

Send along a Bloomberg Ticker, CUSIP, ISIN or deal series name to this endpoint, and it will return a list of all the identifiers for the relevant bond series. You can then query the entire deal by passing along these identifiers to our bonds API endpoint. For your convenience, both of these queries have been linked together on the demo spreadsheet (see link below). Like the All Bonds endpoint, the Deal Class endpoint is costless from a quota perspective.

View our updated API docs and download the demo spreadsheet: empirasign.com/api-mbs

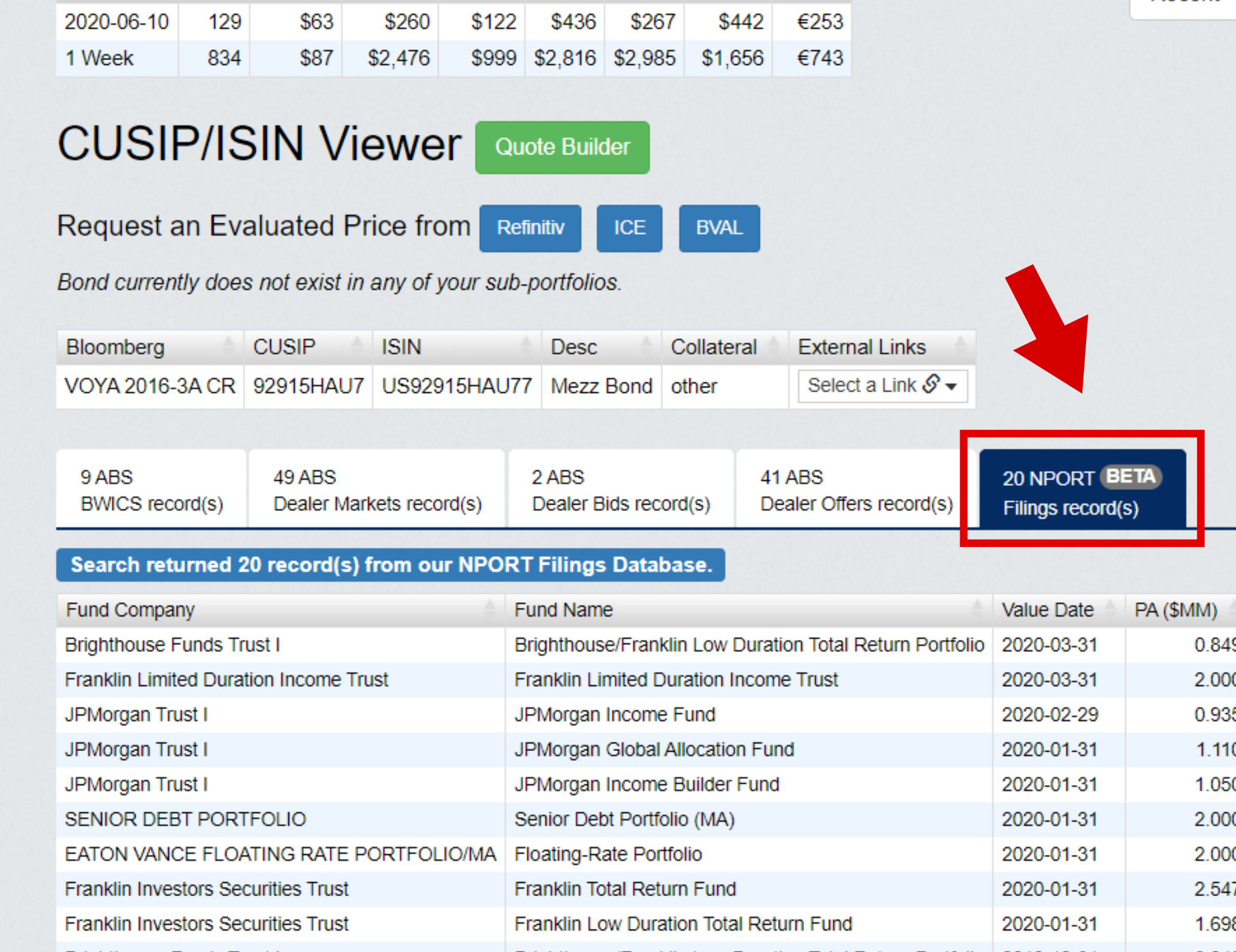

NPORT Filings

June 23, 2020Reveal position holders for any bond in the Empirasign database.

Our latest integration of data from the SEC's EDGAR database enables Empirasign users to instantly view which funds currently hold positions in any bond searched via our web app or API.

Also referred to as NPORT-P, these monthly filings disclose the complete portfolio holdings of all US-registered investment management companies and ETFs in compliance with accounting and reporting protocols mandated by the SEC. While these reports are publicly available on the SEC's website, the EDGAR system does not allow one to search filings by bond identifier - rather, forms from each filing entity must be examined individually. Our advanced spidering and correlating technologies eliminate the grunt work from the research process, allowing users to instantly view every fund with current or previous positions in any bond stored in our database. Simply navigate to the new 'N-PORT' tab found on the trade history page of every bond with data available in the SEC's N-PORT filing records.

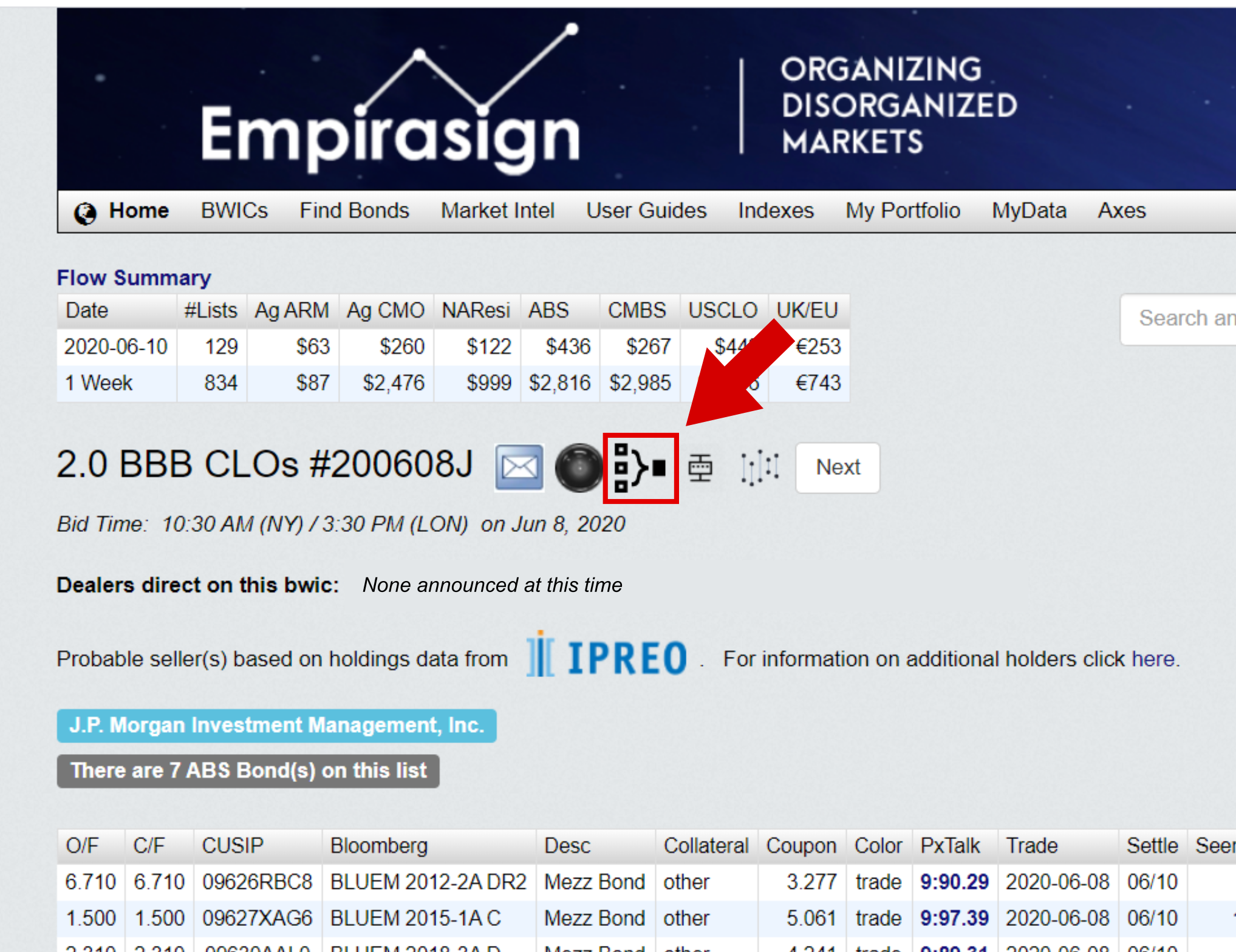

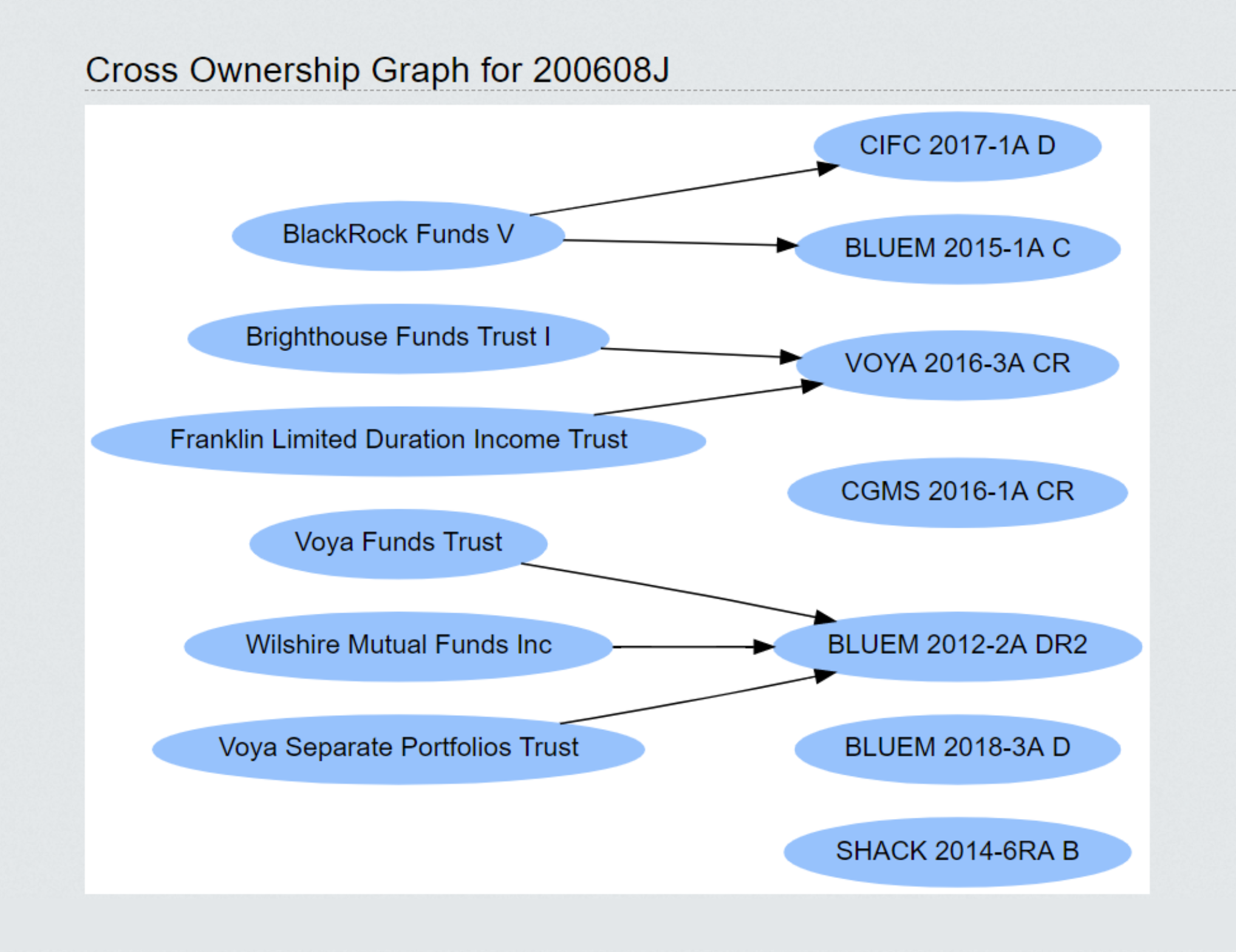

We've also made this information observable at the BWIC level; you'll find the Cross Ownership graph icon at the top of every bid list page. These graphs allow you to easily visualize the current holders of every bond in the list.

Additional Resources

Detailed information on N-PORT Filings can be found via this link. Further information on the SEC's Accounting and Disclosure obligations can be found here. An example filing summary page for a large fixed income ETF can be found here.

More To Come

We've only just begun to scratch the surface of the invaluable market intel that can be derived from these reports. Stay tuned for updates on our future integrations, including:

- Outlier detection for fund security valuation and ASC 820 liquidity level assignments.

- Holdings data will be used to enhance and extend our Collaborative Search feature.

- Concentration Reporting: See which funds own all, or a controlling interest, of a tranche.

- Deeper API Integration: While N-PORT data is already returned on single bond and bulk bond queries (set nport flag to true), additional N-PORT specific endpoints are in the works.

- Flat file delivery: receive daily updates on the entire N-PORT universe to upload into your own private data warehouse.

Empirasign Deal Tracker

May 6, 2020Automatically monitor live market activity across all tranches in a deal.

Our new Deal Tracker feature allows Empirasign users to automatically monitor real-time secondary market activity for every bond in a selected deal. Simply navigate to Deal Tracker under the "My Portfolio" tab, enter a deal name in the search bar, and instantly generate a Watch List by clicking on the Add selected tranches button.

The automatically generated Watch List will be tagged as DEALNAME__dt (LNSTR_2017-5__dt in the above example). That's it, you're done. Now any time a bond in the deal Watch List appears on a BWIC, Dealer Run, or Axe Posting, you will receive a real-time Bloomberg message, email alert, or browser notification (just as you would for any manually-specified Watch List).

A summary of all the recent market activity you are following can be found on the My Current Activity page under the "My Portfolio" tab. Portfolio Activity can be filtered to show only market data for a specific deal under "View a Sub-Portfolio." All Watch Lists generated via Deal Tracker will have the suffix __dt appended to the tag name.

In order to receive market activity alerts for a deal, Portfolio alerts must be enabled. You can manage your alert settings via the My Alerts/Recaps page, also located under the "My Portfolio" tab.

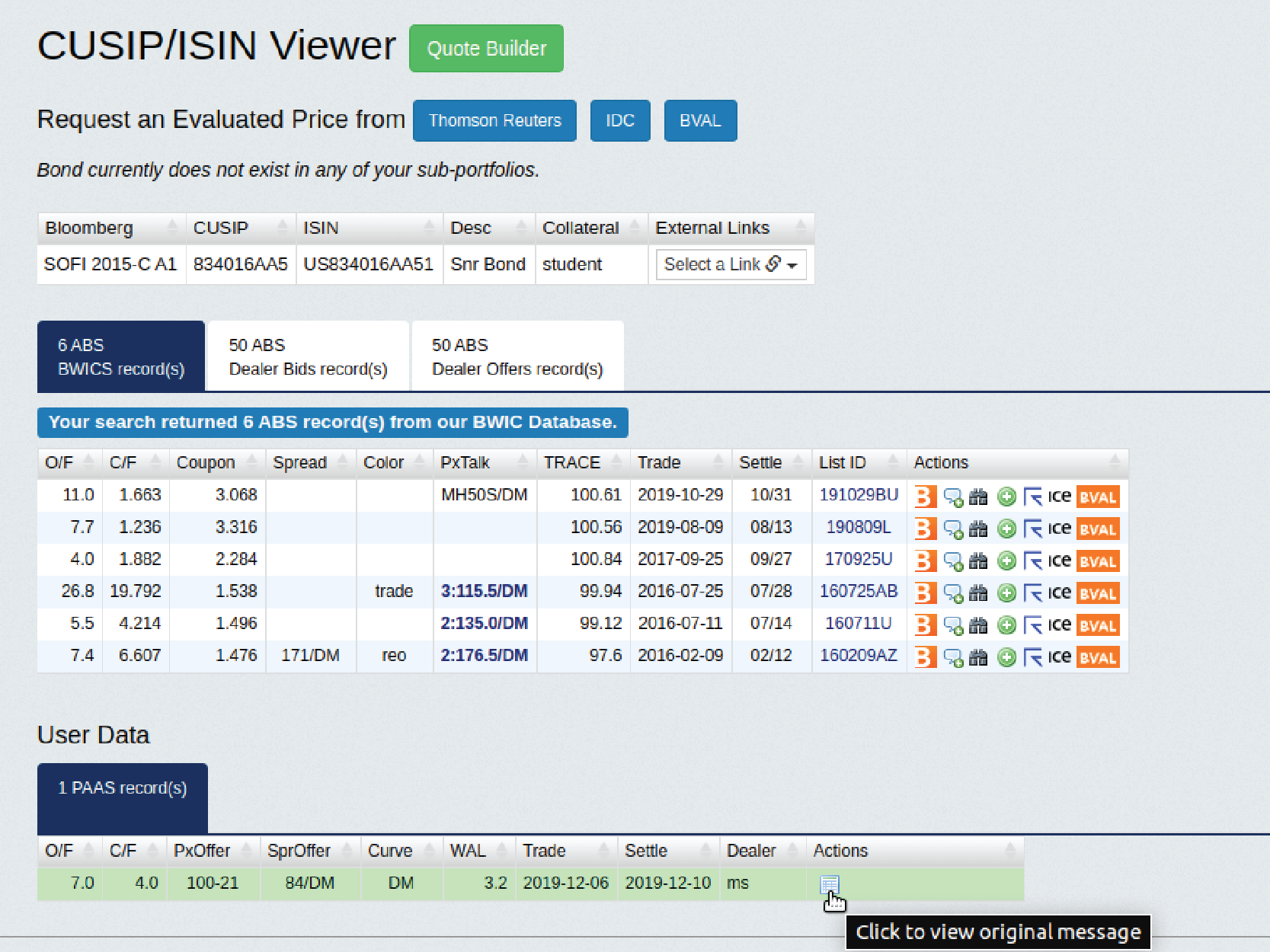

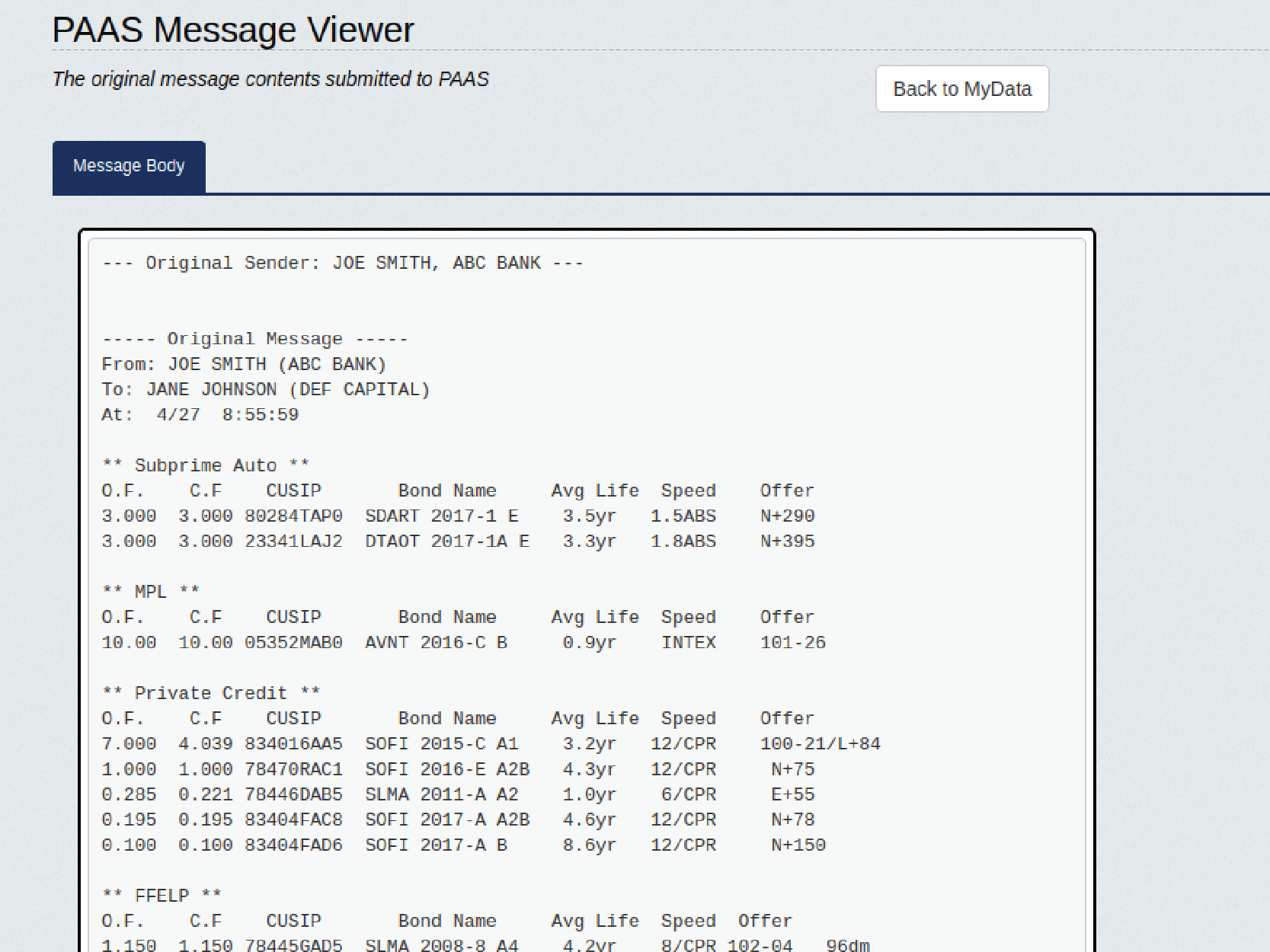

Empirasign Parse and Store

March 11, 2020Empirasign's Parser as a Service streamlines the challenging Extract, Transform, & Load process into a simple API call. And now you can now simplify and extend the process even further with our Parse & Store add-on.

About Parser as a Service

All those offer sheets and benchmark runs perpetually overwhelming your company's inboxes can now be professionally transformed into structured data that's ready for uploading into your own database. Simply send Empirasign your Outlook, Bloomberg, or any other RFC-compliant email messages via:

-

API: Programmatically send your messages to our API endpoint, and our parser will automatically return fully-parsed, normalized and validated JSON output.

-

Email forwarding: Opt to have Empirasign set up a personalized email dropbox for you. Forward your parsing needs to this dropbox, and our parsing agents will autonomously scan and parse these messages in real time.

Add Parse & Store

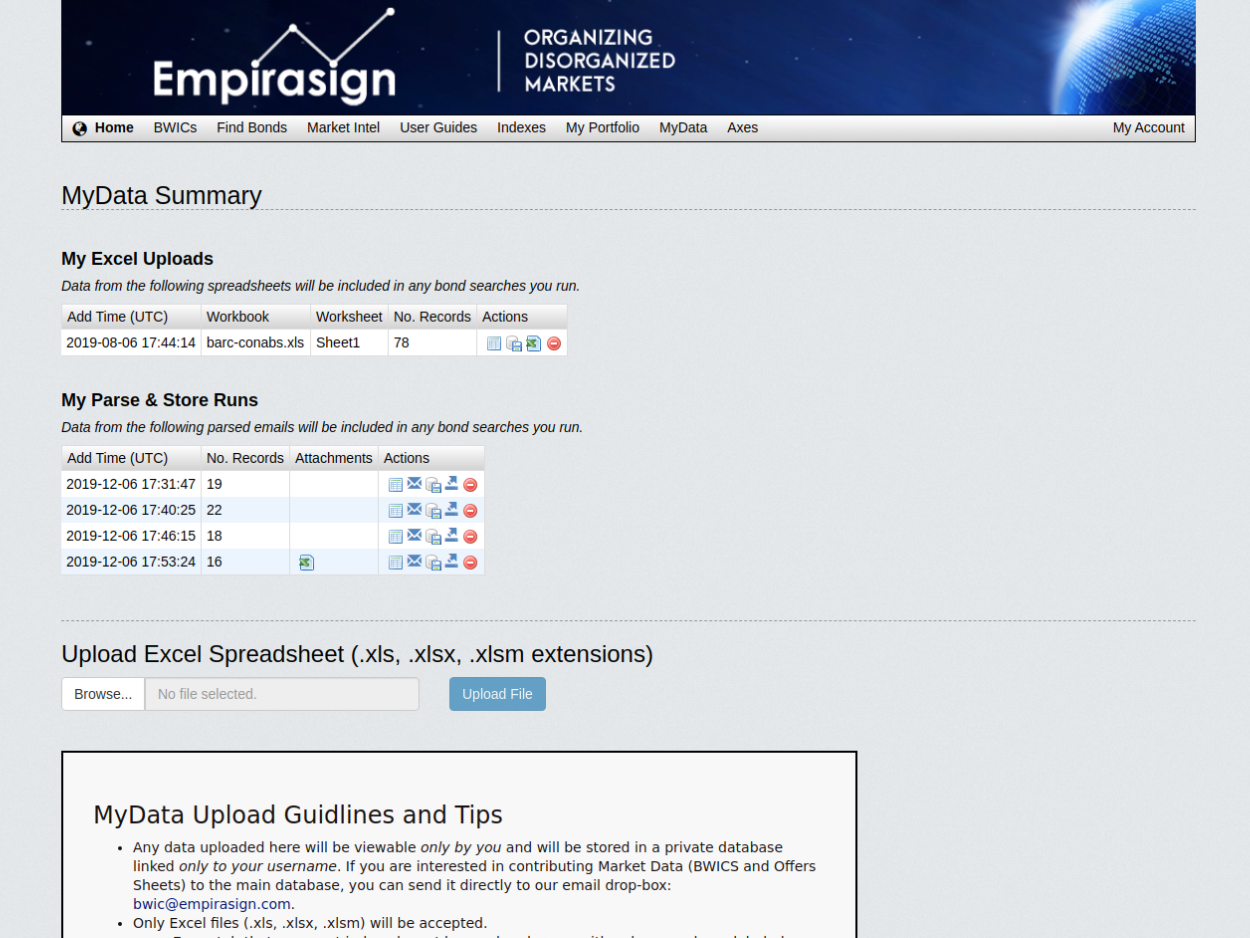

This feature allows you to store your newly transformed market data on our privately-hosted database, where it becomes accessible at any time via the Empirasign web app or API. On-premises storage options are available as well. Parse & Store uploads are only viewable to you and permissioned members of your own organization.

Every time you search for a bond on the Empirasign web app or API, your search results will encompass both Empirasign data as well as all relevant data from your Parse & Store results. A summary of your Parse & Store runs is available on your MyData page, where you can manage your uploads or view original messages.

Access all of your private market data and the entire Empirasign public database on one screen. Maximum insights, minimum grunt work and screen space.

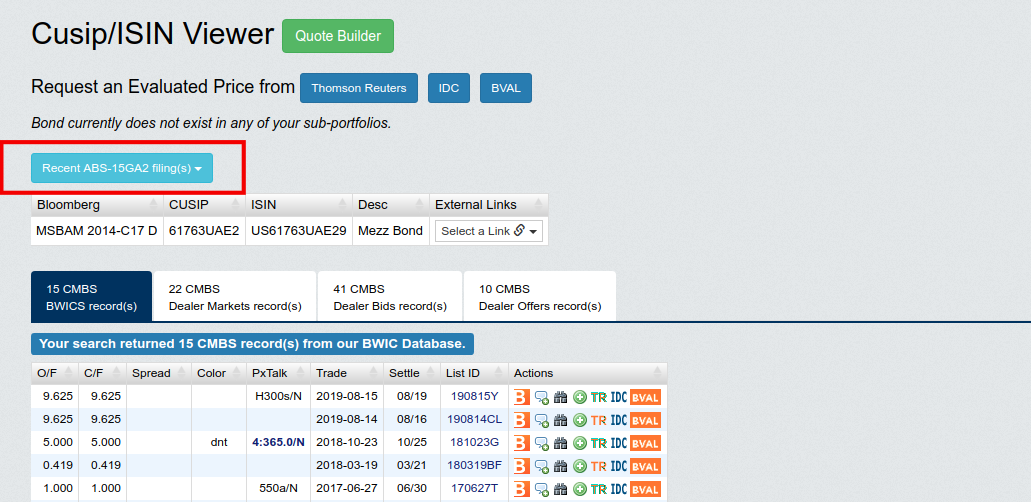

Correlated Real-Time EDGAR Data

Aug. 21, 2019Empirasign is pleased to announce that we now index ABS-15GA1 and 15GA2 filings from the US Securities and Exchange Commission's EDGAR database on a real-time basis. ABS-15GA1 filings are announcements of repurchase events (or lack thereof) for Asset-Backed securities. ABS-15GA2 filings are third-party due diligence reports. These have the nice side effect of serving as a new issue canary.

While publicly available, these filings are largely devoid of commonly used identifiers such as CUSIPs, ISINs, or tickers. Instead, they contain the SEC's preferred identifier of Central Index Key (CIK). The two CIKs of interest to those in Structured Products are Issuer and Depositor. These largely correlate to what the market generally considers a deal series and issuer. The trick, other than the real-time indexing of such useful reports, is to be able to cross-reference these CIKs to identifiers more commonly used in the marketplace. Once you have access to real-time filings and commonly used identifiers, you can then link them to secondary market activity and create useful and valuable market surveillance tools.

Our spidering efforts of publicly available documents on EDGAR and other investor relations pages have made great headway in this cross-referencing effort (with more to come). When viewing a bond quote or BWIC on Empirasign, our users are alerted to possible regulatory events driving the sale such as the seller rolling into a new issue, or a spike in repurchase requests versus the last quarter.

Where You'll See This Data

CUSIP, ISIN, and Bloomberg Ticker Search Results

If there are recent ABS-15GA1 or 15GA2 filings for the bond you queried, drop-down menu(s) will appear at the top of the results page with the dates they were filed and links to each filing on the SEC website.

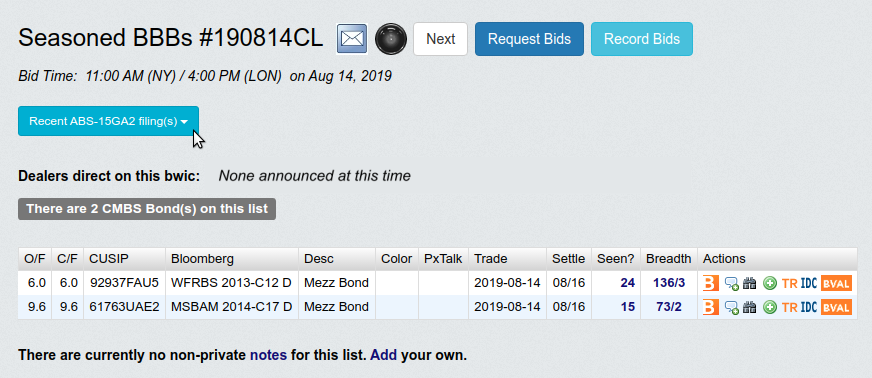

Individual BWIC Pages

If at least one bond on a bid list can be linked to a recent ABS-15GA1 or 15GA2 filing, drop-down menu(s) will appear at the top of the BWIC page with the dates they were filed and links to each filing on the SEC website.

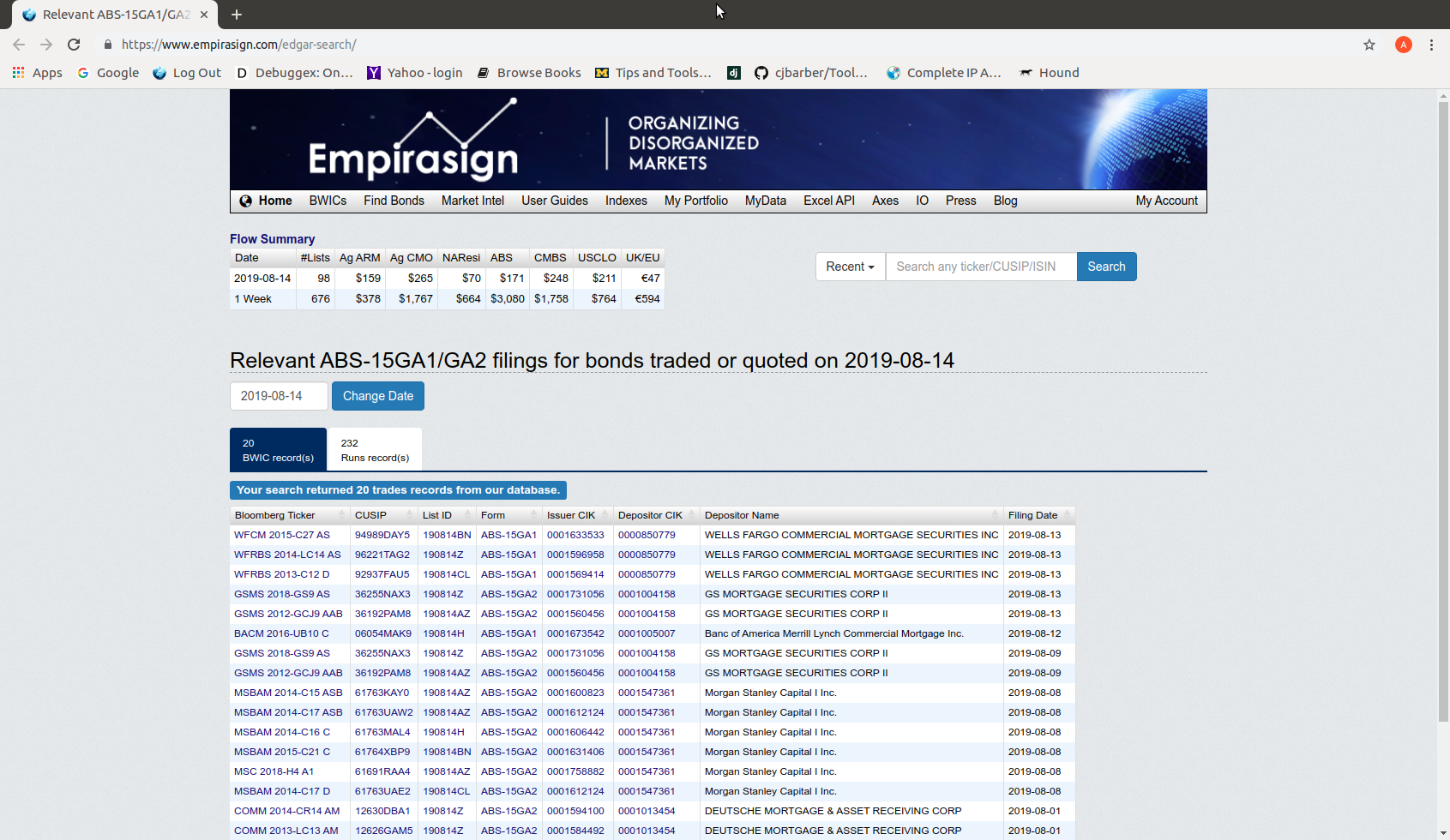

New EDGAR Filings Search Page

This page allows you to view all the bonds that saw market activity mentioned in ABS-15GA1/GA2 filings around the date you queried. For each line item, we list:

- Bloomberg Ticker - linked to the bond's search results page on Empirasign

- CUSIP - linked to the bond's search results page on Empirasign

- List ID - linked to BWIC page on Empirasign

- Form - linked to ABS-15GA1/GA2 filing on EDGAR website

- Issuer CIK - linked to all CIK filings for that Issuer on EDGAR website

- Depositor CIK - linked to all CIK filings for that Depositor on EDGAR website

- Depositor Name

- Filing Date

You'll find this page under Market Intel - EDGAR Filings Search in the top navigation bar.

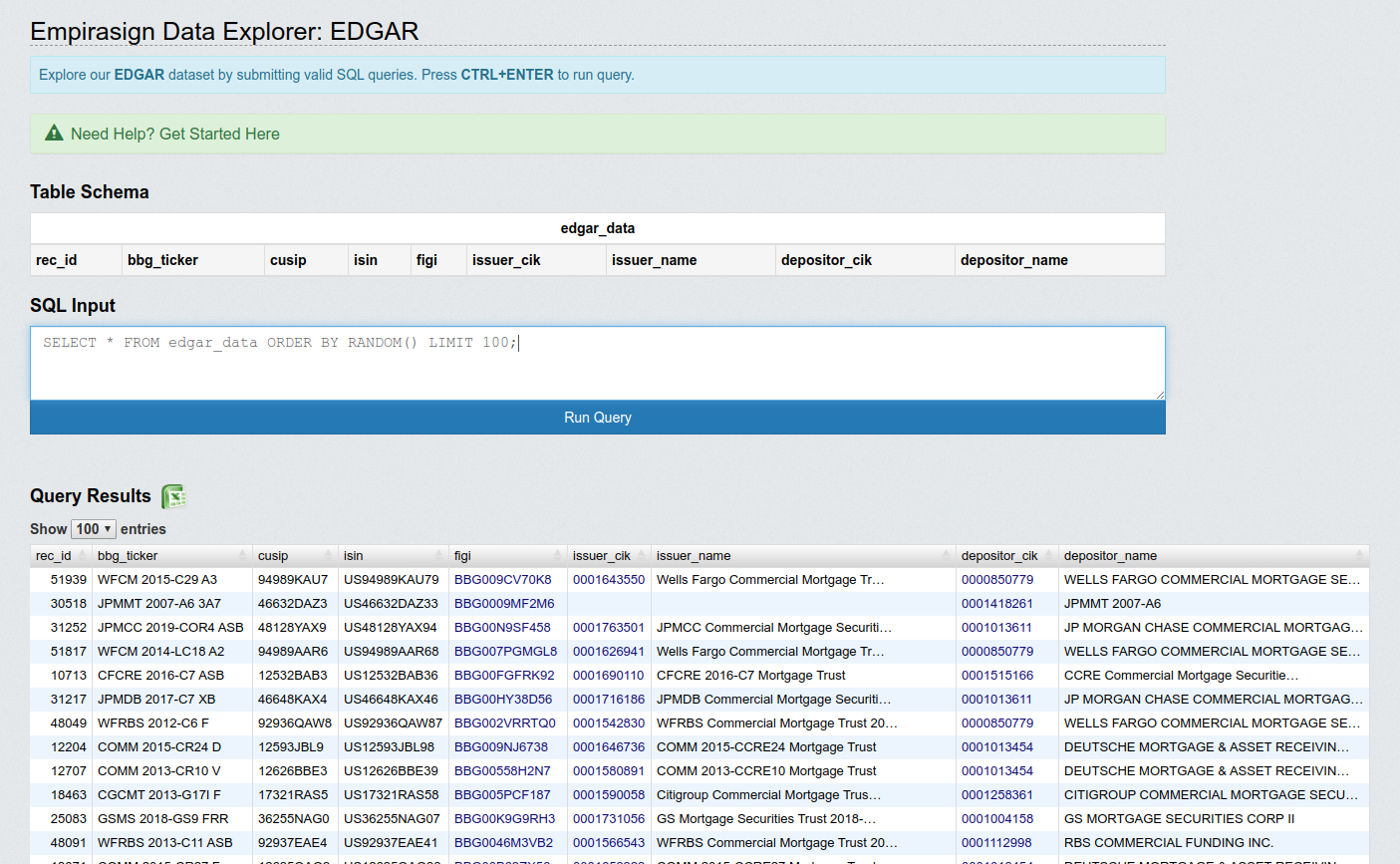

Cross Reference All the Things

Empirasign clients now get SQL access to the same database table we use to correlate secondary market activity to SEC Edgar Filings. Using sqlite in the background, you can slice and dice however you sit fit and export results to Excel. More linked fields, such as LEI, to come in the near future.